Difference between revisions of "National Debt 101"

| Line 1: | Line 1: | ||

{{Article | {{Article | ||

|HasCategory=Debt | |HasCategory=Debt | ||

| − | |||

| − | |||

|HasSummary=Our Government has not done well at financial management and we are in deep financial trouble. As of May 19, 2013, when our debt limit was reached, we owed an unprecedented $16.7 trillion – larger than the entire U.S. economy, as measured in gross domestic product (GDP). It is clear that we must increase our income, cut our spending and start paying off our debt. | |HasSummary=Our Government has not done well at financial management and we are in deep financial trouble. As of May 19, 2013, when our debt limit was reached, we owed an unprecedented $16.7 trillion – larger than the entire U.S. economy, as measured in gross domestic product (GDP). It is clear that we must increase our income, cut our spending and start paying off our debt. | ||

Our Government is supposed to operate on an annual budget. But, for a couple of years we operated without a budget, then, in 2014, a budget was adopted that actually showed a reduction in the national debt - but it is projected to increase again soon. | Our Government is supposed to operate on an annual budget. But, for a couple of years we operated without a budget, then, in 2014, a budget was adopted that actually showed a reduction in the national debt - but it is projected to increase again soon. | ||

| Line 8: | Line 6: | ||

To make matters worse, politicians take advantage of their power in order to be reelected – in many ways. Our President and many in Congress are willing to simply increase the debt limit and continue out-of-control government spending. | To make matters worse, politicians take advantage of their power in order to be reelected – in many ways. Our President and many in Congress are willing to simply increase the debt limit and continue out-of-control government spending. | ||

But, solving this debt issue is essential for our future. | But, solving this debt issue is essential for our future. | ||

| + | |HasAuthor=Glenn | ||

| + | |HasArticleDate=2014/04/07 | ||

}} | }} | ||

{{SectionDefault | {{SectionDefault | ||

| − | |HasArticleText=As of May 19, 2013, when our debt limit was reached, we owed an unprecedented $16.7 trillion-larger than the entire U.S. economy as measured in gross domestic product (GDP). We, as a nation, were earning 16 trillion per year at the time. This debt is paid using the government's income - which is primarily taxes collected - not the nation's income - GDP. To put this in perspective, let's look at the dilemma that a typical family with the same financial situation would have. | + | |HasArticleText=Our government is currently spending about 23% more than its income each year – and its current debt is about six times its annual income. This cannot continue indefinitely and this may well be the biggest threat to your financial future. |

| + | |||

| + | ==Insight Into the Debt Issue== | ||

| + | |||

| + | As of May 19, 2013, when our debt limit was reached, we owed an unprecedented $16.7 trillion-larger than the entire U.S. economy as measured in gross domestic product (GDP). We, as a nation, were earning 16 trillion per year at the time. This debt is paid using the government's income - which is primarily taxes collected - not the nation's income - GDP. To put this in perspective, let's look at the dilemma that a typical family with the same financial situation would have. | ||

| + | |||

| + | |||

| + | [[File: NationalDebt101-1.jpg|none|link=]] | ||

| + | |||

| + | |||

| + | It is clear that this "typical" family must increase its income, cut its spending and start paying off its debt. This is a major problem that our "national family" must fix, but the problem is not being addressed. | ||

| + | |||

| + | Read more: [http://www.heritage.org/research/factsheets/2013/08/getting-americas-debt-under-control?utm_source=heritagefoundation&utm_medium=print&utm_campaign=hmn&utm_content=q1_14_debt Getting America's Debt Under Control] | ||

| + | |||

| + | Read more: [http://www.pewresearch.org/fact-tank/2013/10/09/5-facts-about-the-national-debt-what-you-should-know/ 5 Facts About The National Debt: What You Should Know] | ||

| − | + | ==Understanding Our National Income== | |

| − | + | The gross domestic product (GDP) measures the national income and output for a given country's economy. It is now about $17 trillion and has been growing slowly for the past five years. Source–[http://www.tradingeconomics.com/united-states/gdp United States GDP] | |

| − | |||

| − | |||

| − | + | ==Understanding Our National Debt Problem== | |

| − | + | Looking back, the debt, and the debt as a percentage of GDP, have been increasing rapidly for the past 15 years, and the Congressional Budget Office projects that it will continue to increase for the foreseeable future. | |

| − | |||

| − | + | [[File: NationalDebt101-2.jpg||none|link=http://www.supportingevidence.com/Government/fed_debt_over_time.html]] | |

| − | + | Source–[http://www.supportingevidence.com/Government/fed_debt_over_time.html Read more…] | |

| − | |||

| − | + | [[File: NationalDebt101-3.jpg|none|link=http://www.tradingeconomics.com/united-states/government-debt-to-gdp]] | |

| − | + | Source–[http://www.tradingeconomics.com/united-states/government-debt-to-gdp Read more…] | |

| − | |||

| − | + | [[File: NationalDebt101-4.jpg|none|link=http://cbo.gov/publication/44521]] | |

| − | [ | + | Source–[http://cbo.gov/publication/44521 Read more…] |

| − | + | Clearly, our nation has not done well at financial management and we are in deep financial trouble. And to make matters worse, about 30% of our debt is held by the foreign governments. To understand how deep the trouble is, let's look at it in the same terms that we used for the typical family - national debt versus national income. Ten years ago our "national family's" credit card debt was a little over half our annual income and since then it has grown precipitously to be larger than our entire annual income. | |

| − | For | + | For more understanding of our debt situation, [http://www.pewresearch.org/fact-tank/2013/10/09/5-facts-about-the-national-debt-what-you-should-know/ click here]. |

| − | For an | + | For an in-depth understanding of our debt situation, [http://en.wikipedia.org/wiki/National_debt_of_the_United_States#Foreign_holdings click here]. |

You can see the instantaneous values of many aspects of our national debt [http://www.usdebtclock.org/ here]. | You can see the instantaneous values of many aspects of our national debt [http://www.usdebtclock.org/ here]. | ||

| − | + | ==How Do We Fix the Problem== | |

| − | + | So, what would the "typical family" do? Probably go to Dave Ramsey.com to get free financial advice and here's what they would see first: | |

| − | + | :''"Let's face it—money is emotional. If you feel out of control, stressed, or maybe even guilty or ashamed about money choices, take control back with a [http://www.daveramsey.com/specials/mytmmo-gazelle-budget/ictid/gs2.02091212.mytmmolp.gsfeb/?income=Choose+an+income&s_kwcid=TC%257C6886%257Cdave%20ramsey%257C%257CS%257Ce%257C24924890426&gclid=CIHQ_qef_rwCFcZZ7Aod3yIAJg zero-based budget]. Name every dollar, coming in and going out. Leave the guilt and worry behind and move forward with confidence!"'' | |

| − | + | Our "national family" is supposed to do the budget thing each year. But, it is almost never zero-based. | |

| − | + | For a couple of years the government has operated without a budget - but used something called a continuing resolution - then, in 2014, a budget was adopted that actually showed a reduction in the national debt - but not much and only for a year or so. Then the debt starts going up again. Source–[http://blogs.reuters.com/gregg-easterbrook/2011/03/09/the-federal-spending-controversy/ Read more…]. | |

| − | |||

| − | + | [[File: NationalDebt101-4.jpg|none|link=http://cbo.gov/publication/44521]] | |

| − | |||

| − | + | Bottom line, we have to: | |

| − | + | :'''Cut spending''' | |

| − | + | :'''Increase GDP''' | |

| − | Why | + | ::Why GDP, why not just raise taxes? Because raising taxes doesn't raise the "family" income - it just takes from some "family" members to give to other family members – and to many who are not family members. We paid 117 billion dollars to foreign debtors last year just to pay the interest on our debt. Source–[http://www.pewresearch.org/fact-tank/2013/10/09/5-facts-about-the-national-debt-what-you-should-know/ interest on our debt]. |

| − | + | :'''Start paying off the debt''' | |

| − | + | As a nation, we have to face up to all three of these aspects of our desperate financial situation, so let’s look at each. | |

| − | + | ==Cut Spending== | |

| − | + | In fiscal year 2015, the federal government is projected to spend around $3.9 trillion. These trillions of dollars make up a considerable chunk – around 21 percent – of the U.S. economy, as measured by Gross Domestic Product (GDP). That means that federal government spending makes up a sizable share of all money spent in the United States each year. So, where does all that money go? Source–[http://nationalpriorities.org/budget-basics/federal-budget-101/spending/?gclid=CMPskpixib0CFRFnOgodQEQAag Read more…]. | |

| − | Everybody would agree that we should start by cutting waste but, one man's waste is another man's pet project. So, it's an ongoing debate within the government. For our purposes, let's define | + | Everybody would agree that we should start by cutting waste but, one man's waste is another man's pet project. So, it's an ongoing debate within the government. For our purposes, let's define waste as those government expenditures that a large majority of taxpayers would agree just shouldn't be done. Frequently it in done in violation of the original intent of the enabling legislation, but enabled by the regulations that are used to administer the Act. Here is an example: |

| − | A surfing, lobster-eating 29 year-old food stamp recipient who has no job and who refuses to accept a job does not violate the regulations. You can understand his reasoning and the inherent difficulty of government regulations [http://nation.foxnews.com/2014/03/14/lobster-eating-food-stamp-recipient-refuses-hannitys-job-help here]. | + | :''A surfing, lobster-eating 29 year-old food stamp recipient who has no job and who refuses to accept a job does not violate the food stamp regulations. You can understand his reasoning and the inherent difficulty of government regulations [http://nation.foxnews.com/2014/03/14/lobster-eating-food-stamp-recipient-refuses-hannitys-job-help here].'' |

| − | There are many popular government programs that are much-needed but have become outdated and thus have some major expenditures that a majority of the taxpayers would not agree with. | + | There are many popular government programs that are much-needed but have become outdated and thus have some major expenditures that a majority of the taxpayers would not agree with. For example: |

| − | The original intent of the Social Security Act was to take care of those who couldn't take care of themselves. It was based on a required pension fund like that of the Railroad at the the time. We have used it as a social reform instrument ever since. We have added so many additional benefits that it is consuming the largest part of our national budget. Fraud is rampant, survivor benefits are going to 3rd and 4th generations, amendments, addendums, and reclassifications for benefits are being used for any and all political gains, the system has run | + | :''The original intent of the Social Security Act was to take care of those who couldn't take care of themselves. It was based on a required pension fund like that of the Railroad at the the time. We have used it as a social reform instrument ever since. We have added so many additional benefits that it is consuming the largest part of our national budget. Fraud is rampant, survivor benefits are going to 3rd and 4th generations, amendments, addendums, and reclassifications for benefits are being used for any and all political gains, the system has run amuck. It's cost is XX percent of the budget and there are ongoing debates on how to reform it. One approach being proposed is [http://www.aarp.org/content/dam/aarp/research/public_policy_institute/econ_sec/2012/option-means-test-social-security-benefits-AARP-ppi-econ-sec.pdf means testing], and there is a proposal in which no one who has a [http://whatbigjohnthinks.hubpages.com/hub/Fixing-Social-Security retirement income over $110,000] would receive Social Security benefits. Source–[http://www.cbpp.org/cms/?fa=view&id=1258 Read more…]'' |

| − | + | :''This is a highly complex issue and the multiple changes have been suggested and debated. Source–[http://en.wikipedia.org/wiki/Social_Security_(United_States)#Claim_that_it_discriminates_against_the_poor_and_the_middle_class Read more…].'' | |

Administering all the government regulations is a huge undertaking and mismanagement contributes to a lot of waste. To get a sense of the magnitude of the effort, there have been 1.43 million pages added to the regulations since 1993. Here is an example of this type waste: | Administering all the government regulations is a huge undertaking and mismanagement contributes to a lot of waste. To get a sense of the magnitude of the effort, there have been 1.43 million pages added to the regulations since 1993. Here is an example of this type waste: | ||

| − | The government owns many buildings that are unused - and not likely to ever be used for government purposes. The Office of Management and Budget says [http://www.npr.org/2014/03/12/287349831/governments-empty-buildings-are-costing-taxpayers-billions these buildings] could be costing taxpayers $1.7 billion a year. | + | :''The government owns many buildings that are unused - and not likely to ever be used for government purposes. The Office of Management and Budget says [http://www.npr.org/2014/03/12/287349831/governments-empty-buildings-are-costing-taxpayers-billions these buildings] could be costing taxpayers $1.7 billion a year.'' |

| − | Politicians take advantage of their power to be reelected | + | Politicians take advantage of their power to be reelected in many ways. Probably the best-known are congressional earmarks and loopholes. Each year, Sen. Tom Coburn publishes a Wastebook identifying what he considers to be government waste. Here's a quote from the introduction of his 2013 Wastebook "While politicians in Washington spent much of 2013 complaining about sequestration's impact on domestic programs and our national defense, we still managed to provide benefits to the Fort Hood shooter, study romance novels, help the State Department buy Facebook fans and even help NASA study Congress. Source–[http://civicwiki.org/w/index.php?title=Politicizing_Metrics_101#The_Big_Problem Read more…] |

| − | + | Additionally, there is an "operational" waste. In engineering you are taught that all processes, of, all kinds have “waste” and the more complex the process, the greater the waste. This is true for processes used by our government. Our national governance system is huge and there is huge waste that is not politically motivated. For example, the IRS recently spent more than four million dollars on one lavish conference. Source–[http://www.heritage.org/research/factsheets/2013/08/getting-americas-debt-under-control?utm_source=heritagefoundation&utm_medium=print&utm_campaign=hmn&utm_content=q1_14_debt Getting America's Debt Under Control] | |

| − | + | ==Increase GDP== | |

| − | + | “Policymakers are divided as to whether government expansion helps or hinders economic growth…If government spends money in a productive way that generates a sufficiently high rate of return, the economy will benefit, but this is the exception rather than the rule. There is overwhelming evidence that America's economy could grow much faster if the burden of government was reduced. Source–[http://www.heritage.org/research/reports/2005/03/the-impact-of-government-spending-on-economic-growth Read more…] | |

| − | + | ==Start Paying Off the Debt== | |

| − | [http:// | + | This won’t happen until we elect a president and legislature that are committed to do this. And, are willing to work together to get it done. Even then it won’t be easy. It will require both the elimination of waste and providing a regulatory environment for the private sector that promotes growth of the GDP. So, basically it’s up to the voters to get informed, to get involved and elect the right people. |

| + | |||

| + | Why can't our government come to grips with this problem? They have the same problem that the typical family has; who gets more and who gets less. These are tough questions in a typical family, where the wants and needs of the family members are well understood and the decision-makers goal is to do what's best for the family. It is much tougher for the national family for three primary reasons: | ||

| + | |||

| + | #The needs of the "family" members are much more difficult to understand. | ||

| + | #There are 536 people directly involved in the decision-making process - which includes the House of Representatives, The Senate and the President. | ||

| + | #In the political environment, the primary goal for decision makers - with maybe a few exceptions - is to get reelected and they use their power for that purpose. So, they do favors for their constituents - both those who are voters in their elections and, especially, for those who contribute to their campaigns - the bigger contributions, the bigger the favors. This leads to huge government waste. Source–[http://civicwiki.org/w/index.php?title=Politicizing_Metrics_101#The_Big_Problem Read more…] | ||

| + | |||

| + | ==What Happens If We Don’t Fix the Problem== | ||

| + | |||

| + | It's clear that our "national family" is in deep trouble. If we don't do something soon, our credit rating will go into the tank, our interest rates will skyrocket, and we will go bankrupt. So what's it like for a government to go bankrupt. Well, the city of Detroit did so in 2013 and here are some excerpts from a report that will shed some light on it: | ||

| − | + | :''In his ruling, the judge said: "The city needs help,". Detroit is facing "mounting crime rates, spreading blight and a deteriorating quality of life. The city no longer has the resources to provide its residents with basic police, fire and services."'' | |

| − | + | :''The city had a population of close to 2m in the 1950s and is now down to around 700,000, more than a third of them living in poverty.'' | |

| − | + | :''The filing is unlikely to end an already heated dispute with city workers, who represent Detroit's largest creditors. The city's workers are owed $3.5bn in pension payments and another $6bn in healthcare costs. Under one proposal floated before the bankruptcy was approved creditors would receive just 16¢ on the dollar for the pensions they are owed. The [http://www.theguardian.com/world/2013/dec/03/detroit-bankruptcy-protection-judge-rules average Detroit pensioner] gets $19,000 a year - the cut would leave them with $3,040.'' | |

Many of our leaders are willing to simply increase the debt limit and continue out-of-control government spending. But, solving this debt issue is essential for our future, and it is a very tough and complex problem. You can get a more in-depth understanding of the debt problem and a suggested approach - Saving the American Dream - at the [http://www.heritage.org/research/reports/2011/05/saving-the-american-dream-the-heritage-plan-to-fix-the-debt-cut-spending-and-restore-prosperity Heritage Foundation website]. | Many of our leaders are willing to simply increase the debt limit and continue out-of-control government spending. But, solving this debt issue is essential for our future, and it is a very tough and complex problem. You can get a more in-depth understanding of the debt problem and a suggested approach - Saving the American Dream - at the [http://www.heritage.org/research/reports/2011/05/saving-the-american-dream-the-heritage-plan-to-fix-the-debt-cut-spending-and-restore-prosperity Heritage Foundation website]. | ||

}} | }} | ||

| + | {{Citations}} | ||

Latest revision as of 15:46, 7 August 2014

Contents

Our Government has not done well at financial management and we are in deep financial trouble. As of May 19, 2013, when our debt limit was reached, we owed an unprecedented $16.7 trillion – larger than the entire U.S. economy, as measured in gross domestic product (GDP). It is clear that we must increase our income, cut our spending and start paying off our debt. Our Government is supposed to operate on an annual budget. But, for a couple of years we operated without a budget, then, in 2014, a budget was adopted that actually showed a reduction in the national debt - but it is projected to increase again soon. Everybody would agree that we should start by cutting waste but, one man's waste is another man's pet project. So, it's an ongoing debate within the government. To make matters worse, politicians take advantage of their power in order to be reelected – in many ways. Our President and many in Congress are willing to simply increase the debt limit and continue out-of-control government spending.

But, solving this debt issue is essential for our future.

2014/04/07 User:Glenn

Our government is currently spending about 23% more than its income each year – and its current debt is about six times its annual income. This cannot continue indefinitely and this may well be the biggest threat to your financial future.

Insight Into the Debt Issue

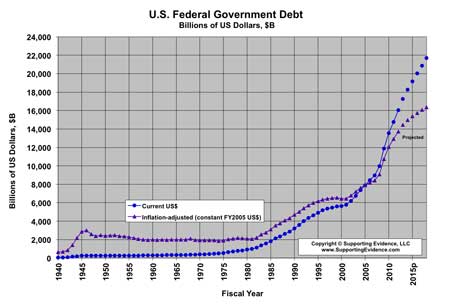

As of May 19, 2013, when our debt limit was reached, we owed an unprecedented $16.7 trillion-larger than the entire U.S. economy as measured in gross domestic product (GDP). We, as a nation, were earning 16 trillion per year at the time. This debt is paid using the government's income - which is primarily taxes collected - not the nation's income - GDP. To put this in perspective, let's look at the dilemma that a typical family with the same financial situation would have.

It is clear that this "typical" family must increase its income, cut its spending and start paying off its debt. This is a major problem that our "national family" must fix, but the problem is not being addressed.

Read more: Getting America's Debt Under Control

Read more: 5 Facts About The National Debt: What You Should Know

Understanding Our National Income

The gross domestic product (GDP) measures the national income and output for a given country's economy. It is now about $17 trillion and has been growing slowly for the past five years. Source–United States GDP

Understanding Our National Debt Problem

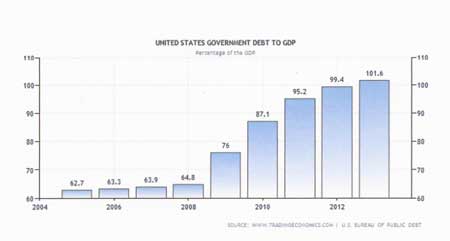

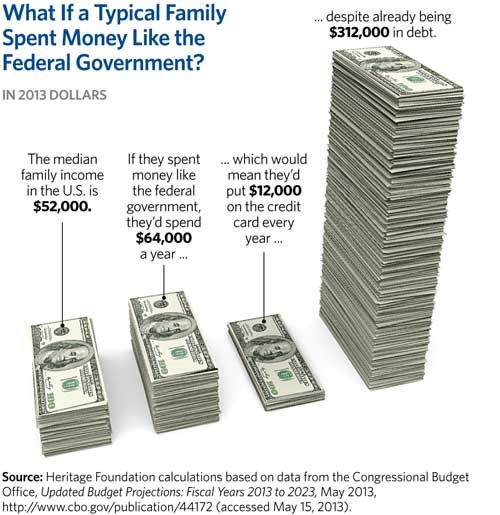

Looking back, the debt, and the debt as a percentage of GDP, have been increasing rapidly for the past 15 years, and the Congressional Budget Office projects that it will continue to increase for the foreseeable future.

Source–Read more…

Source–Read more…

Source–Read more…

Clearly, our nation has not done well at financial management and we are in deep financial trouble. And to make matters worse, about 30% of our debt is held by the foreign governments. To understand how deep the trouble is, let's look at it in the same terms that we used for the typical family - national debt versus national income. Ten years ago our "national family's" credit card debt was a little over half our annual income and since then it has grown precipitously to be larger than our entire annual income.

For more understanding of our debt situation, click here.

For an in-depth understanding of our debt situation, click here.

You can see the instantaneous values of many aspects of our national debt here.

How Do We Fix the Problem

So, what would the "typical family" do? Probably go to Dave Ramsey.com to get free financial advice and here's what they would see first:

- "Let's face it—money is emotional. If you feel out of control, stressed, or maybe even guilty or ashamed about money choices, take control back with a zero-based budget. Name every dollar, coming in and going out. Leave the guilt and worry behind and move forward with confidence!"

Our "national family" is supposed to do the budget thing each year. But, it is almost never zero-based.

For a couple of years the government has operated without a budget - but used something called a continuing resolution - then, in 2014, a budget was adopted that actually showed a reduction in the national debt - but not much and only for a year or so. Then the debt starts going up again. Source–Read more….

Bottom line, we have to:

- Cut spending

- Increase GDP

- Why GDP, why not just raise taxes? Because raising taxes doesn't raise the "family" income - it just takes from some "family" members to give to other family members – and to many who are not family members. We paid 117 billion dollars to foreign debtors last year just to pay the interest on our debt. Source–interest on our debt.

- Start paying off the debt

As a nation, we have to face up to all three of these aspects of our desperate financial situation, so let’s look at each.

Cut Spending

In fiscal year 2015, the federal government is projected to spend around $3.9 trillion. These trillions of dollars make up a considerable chunk – around 21 percent – of the U.S. economy, as measured by Gross Domestic Product (GDP). That means that federal government spending makes up a sizable share of all money spent in the United States each year. So, where does all that money go? Source–Read more….

Everybody would agree that we should start by cutting waste but, one man's waste is another man's pet project. So, it's an ongoing debate within the government. For our purposes, let's define waste as those government expenditures that a large majority of taxpayers would agree just shouldn't be done. Frequently it in done in violation of the original intent of the enabling legislation, but enabled by the regulations that are used to administer the Act. Here is an example:

- A surfing, lobster-eating 29 year-old food stamp recipient who has no job and who refuses to accept a job does not violate the food stamp regulations. You can understand his reasoning and the inherent difficulty of government regulations here.

There are many popular government programs that are much-needed but have become outdated and thus have some major expenditures that a majority of the taxpayers would not agree with. For example:

- The original intent of the Social Security Act was to take care of those who couldn't take care of themselves. It was based on a required pension fund like that of the Railroad at the the time. We have used it as a social reform instrument ever since. We have added so many additional benefits that it is consuming the largest part of our national budget. Fraud is rampant, survivor benefits are going to 3rd and 4th generations, amendments, addendums, and reclassifications for benefits are being used for any and all political gains, the system has run amuck. It's cost is XX percent of the budget and there are ongoing debates on how to reform it. One approach being proposed is means testing, and there is a proposal in which no one who has a retirement income over $110,000 would receive Social Security benefits. Source–Read more…

- This is a highly complex issue and the multiple changes have been suggested and debated. Source–Read more….

Administering all the government regulations is a huge undertaking and mismanagement contributes to a lot of waste. To get a sense of the magnitude of the effort, there have been 1.43 million pages added to the regulations since 1993. Here is an example of this type waste:

- The government owns many buildings that are unused - and not likely to ever be used for government purposes. The Office of Management and Budget says these buildings could be costing taxpayers $1.7 billion a year.

Politicians take advantage of their power to be reelected in many ways. Probably the best-known are congressional earmarks and loopholes. Each year, Sen. Tom Coburn publishes a Wastebook identifying what he considers to be government waste. Here's a quote from the introduction of his 2013 Wastebook "While politicians in Washington spent much of 2013 complaining about sequestration's impact on domestic programs and our national defense, we still managed to provide benefits to the Fort Hood shooter, study romance novels, help the State Department buy Facebook fans and even help NASA study Congress. Source–Read more…

Additionally, there is an "operational" waste. In engineering you are taught that all processes, of, all kinds have “waste” and the more complex the process, the greater the waste. This is true for processes used by our government. Our national governance system is huge and there is huge waste that is not politically motivated. For example, the IRS recently spent more than four million dollars on one lavish conference. Source–Getting America's Debt Under Control

Increase GDP

“Policymakers are divided as to whether government expansion helps or hinders economic growth…If government spends money in a productive way that generates a sufficiently high rate of return, the economy will benefit, but this is the exception rather than the rule. There is overwhelming evidence that America's economy could grow much faster if the burden of government was reduced. Source–Read more…

Start Paying Off the Debt

This won’t happen until we elect a president and legislature that are committed to do this. And, are willing to work together to get it done. Even then it won’t be easy. It will require both the elimination of waste and providing a regulatory environment for the private sector that promotes growth of the GDP. So, basically it’s up to the voters to get informed, to get involved and elect the right people.

Why can't our government come to grips with this problem? They have the same problem that the typical family has; who gets more and who gets less. These are tough questions in a typical family, where the wants and needs of the family members are well understood and the decision-makers goal is to do what's best for the family. It is much tougher for the national family for three primary reasons:

- The needs of the "family" members are much more difficult to understand.

- There are 536 people directly involved in the decision-making process - which includes the House of Representatives, The Senate and the President.

- In the political environment, the primary goal for decision makers - with maybe a few exceptions - is to get reelected and they use their power for that purpose. So, they do favors for their constituents - both those who are voters in their elections and, especially, for those who contribute to their campaigns - the bigger contributions, the bigger the favors. This leads to huge government waste. Source–Read more…

What Happens If We Don’t Fix the Problem

It's clear that our "national family" is in deep trouble. If we don't do something soon, our credit rating will go into the tank, our interest rates will skyrocket, and we will go bankrupt. So what's it like for a government to go bankrupt. Well, the city of Detroit did so in 2013 and here are some excerpts from a report that will shed some light on it:

- In his ruling, the judge said: "The city needs help,". Detroit is facing "mounting crime rates, spreading blight and a deteriorating quality of life. The city no longer has the resources to provide its residents with basic police, fire and services."

- The city had a population of close to 2m in the 1950s and is now down to around 700,000, more than a third of them living in poverty.

- The filing is unlikely to end an already heated dispute with city workers, who represent Detroit's largest creditors. The city's workers are owed $3.5bn in pension payments and another $6bn in healthcare costs. Under one proposal floated before the bankruptcy was approved creditors would receive just 16¢ on the dollar for the pensions they are owed. The average Detroit pensioner gets $19,000 a year - the cut would leave them with $3,040.

Many of our leaders are willing to simply increase the debt limit and continue out-of-control government spending. But, solving this debt issue is essential for our future, and it is a very tough and complex problem. You can get a more in-depth understanding of the debt problem and a suggested approach - Saving the American Dream - at the Heritage Foundation website.